Hard Money Financing

Capital First and its team of knowledgeable and experienced real estate lending professionals thrive at helping real estate investors succeed with there investment strategies. Our processes are fast and flexible to meet the needs of our borrowers. Financing available for foreclosures, REO, Short sale, distressed properties and new construction for non-owner occupied properties.

Our short term loan programs support the following investment projects:

- Fix and Flip

- New Construction

- Cash Out – Refinance

Available States

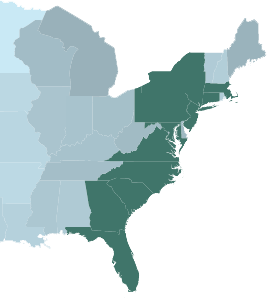

Available States

- New York

- New Jersey

- Connecticut

- Maryland

- Massachusetts

- Virginia

- Florida

- Pennsylvania

- North Carolina

- South Carolina

- Georgia

About Fix and Flip

House flipping, or buying and renovating a home for profit, is an investment strategy that has been highly publicized. However, flipping homes as a profit strategy not only carries risk but demands your time, energy, and attention to detail. Many new house flippers make the mistake of overlooking certain expenses that may impact their net profit–leaving them with results that deviate from what they originally anticipated. Capital First team has over 30 years real estate investment experience and will guide you through the entire process when financing fix and flip project.